2025 Annual Gift Exclusion. Without any changes to the law, the estate and lifetime gift tax exemption will plummet to $5 million per person (with an adjustment for inflation) on january 1, 2026. The new (2025) federal annual gift tax exclusion amount will be $19,000.00

Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year. The exclusion will be $19,000 per recipient for 2025.

Annual Federal Gift Tax Exclusion 2025 Niki Teddie, For example, if you gift $20,000 to one person in 2025, the $2,000 above the $18,000 annual exclusion limit would reduce your lifetime exclusion amount.

Annual Gift Tax Exclusion A Complete Guide To Gifting, The us internal revenue service recently announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume a taxpayer’s federal gift tax exemption and no gift tax return is.

Annual Gift Exclusion 2025 Ardyth Ulrike, Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

Gift Tax 2025 Exclusion Megan Bond, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume a taxpayer’s federal gift tax exemption and no gift tax return is.

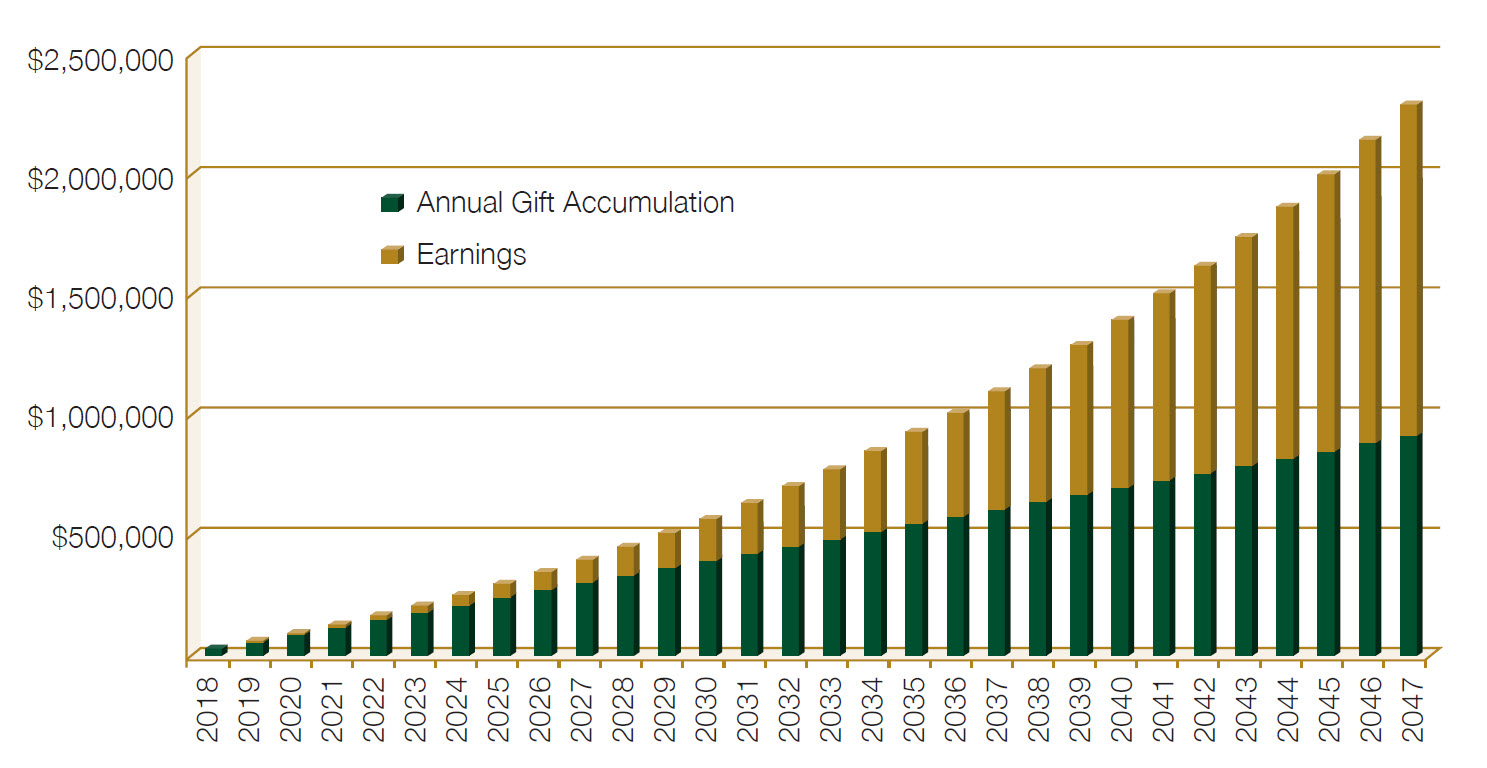

Annual Gift Exclusion 2025 Ardyth Ulrike, This gift tax annual exclusion was indexed for inflation in 1997 and has increased over time as shown below.

Annual Gift Exclusion 2025 Ardyth Ulrike, The gift tax exclusion amount renews annually, so an individual who gifted $18,000 to someone in 2025 may gift $19,000 to that same person in 2025, without any reporting obligation.

Gift Exclusion In 2025 Bride Clarita, The gift tax exclusion amount renews annually, so an individual who gifted $18,000 to someone in 2025 may gift $19,000 to that same person in 2025, without any reporting obligation.

2025 Gift Tax Exclusion Annual Brenn Martica, Gifts made in trust do not qualify for the annual gift exclusion unless the gift recipient has a present interest in the gift, such.